Cannabis has been used for medicinal purposes for thousands of years. However, its use has been controversial for a long time, with some people considering it a dangerous drug, while others support its use for medical purposes. In recent years, the legalization of medical marijuana has gained increased support in the United States, and more states have legalized it. However, a question that often arises is whether medical marijuana is taxable.

Understanding Medical Marijuana

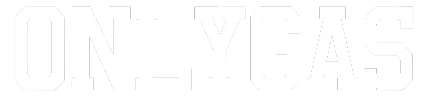

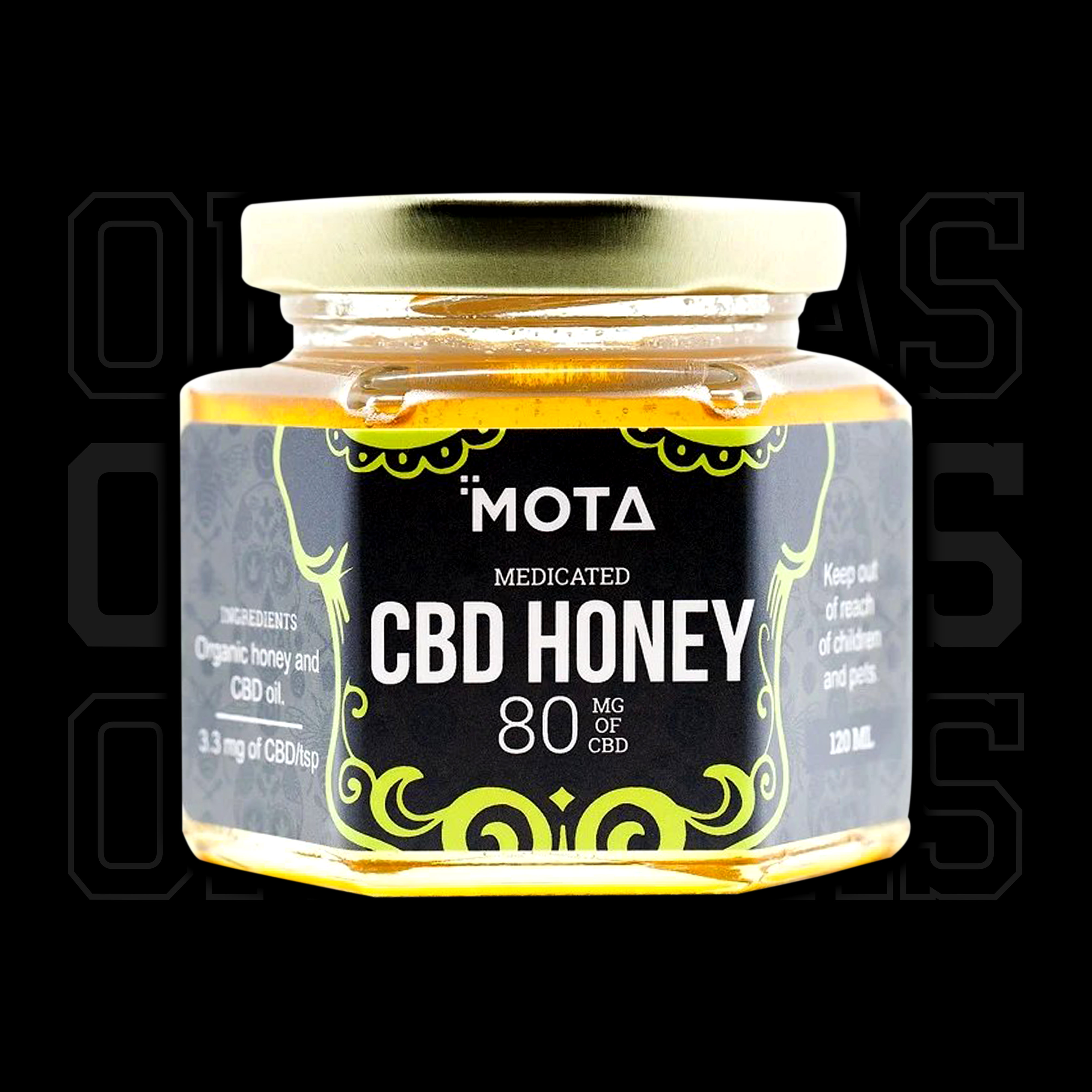

Before we delve into the taxation of medical marijuana, it’s essential to understand what it is. Medical marijuana refers to the use of the whole, unprocessed plant or its extracts to treat symptoms or conditions. The plant contains more than 100 compounds known as cannabinoids, which have different effects on the body. The most commonly known cannabinoids are delta-9-tetrahydrocannabinol (THC) and cannabidiol (CBD). THC is responsible for the psychoactive effects of marijuana. On the other hand, CBD does not have psychoactive effects but has been found to have numerous medical benefits, such as reducing pain and anxiety.

The Legality of Medical Marijuana

The legality of medical marijuana varies from state to state, with some states legalizing it for specific medical conditions, while others do not allow its use at all. The federal government still considers marijuana a Schedule I drug, meaning it has no accepted medical use and has high potential for abuse. However, this has not stopped some states from legalizing it for medical purposes.

The Taxation of Medical Marijuana

Now, onto the taxation of medical marijuana. The short answer is yes; medical marijuana is taxable in states where it is legal. Although it is used for medicinal purposes, it is still considered a taxable commodity. In states where it is legal, medical marijuana is subject to sales tax, excise tax, and other taxes like any other product. The taxes collected from medical marijuana sales go towards public services like schools, roads, and healthcare.

Sales Tax

Sales tax is a tax imposed on the sale of goods and services. Medical marijuana is subject to sales tax in states where it is legal. The sales tax rate varies from state to state, with some states having a higher rate than others. For example, in California, the sales tax on medical marijuana is 15%, while in Colorado, it is 2.9%.

Excise Tax

An excise tax is a tax imposed on specific goods or activities. In states where medical marijuana is legal, it is subject to excise tax. The excise tax rate varies from state to state, with some states having a higher rate than others. For example, in Alaska, the excise tax on medical marijuana is $50 per ounce, while in Pennsylvania, it is 5%.

Other Taxes

Aside from sales tax and excise tax, medical marijuana is also subject to other taxes, such as business taxes and cultivation taxes. Business taxes are imposed on the sale of medical marijuana, while cultivation taxes are imposed on those who grow marijuana for medical purposes.

Conclusion

In conclusion, medical marijuana is taxable in states where it is legal. Although it is used for medicinal purposes, it is still considered a commodity subject to taxes like any other product. The taxes collected from medical marijuana sales go towards public services like schools, roads, and healthcare. The taxation of medical marijuana varies from state to state, with some states having higher tax rates than others. As the legalization of medical marijuana continues to gain support in the United States, it is essential to understand the taxation laws that govern it.